Published on Sunday 30th November 2014 (AEST)

An article published on Seeking Alpha November 24th titled "Uranium Spot Prices Plummet as Buyers Exit the Market" is somewhat misleading and overlooks the nuances of the uranium spot market.

The spot market is thinly traded, driven primarily by one off transactions which can be very volatile (hence the 5% rebound last night bringing U308 spot prices back above $40/pound, after the 8% drop on Friday). Heightened focus on the spot move - on the pages of Seeking Alpha and elsewhere - spurred uranium equities such as Cameco Corp. & Denison to sell-off sharply, despite the fact that their uranium contracts are long term, and not directly related to the spot price on any given day.

The most important points to focus on when analyzing this market are the trajectory of uranium prices (higher), the long-term supply-demand imbalance (and why recent news regarding Japanese restarts is extremely important) and how much uranium-related equities are positioned to benefit given current valuations.

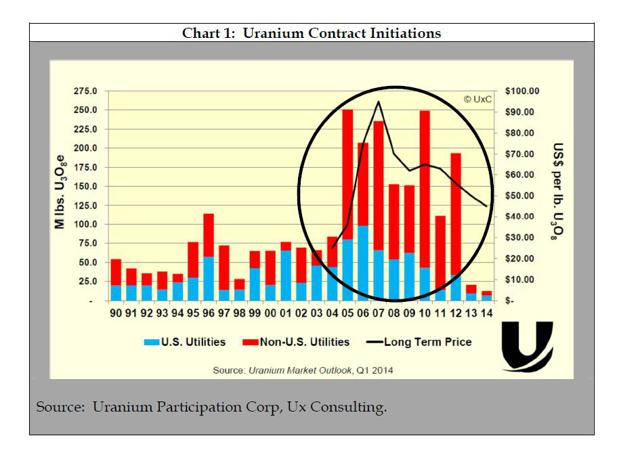

As stated above, the uranium market is not very deep - the buying trends of utilities is critical to the price and can drive large swings in the price on a one-off basis. Our channel checks suggest that most utilities are behind in striking new contracts supplying them with uranium, just as in aggregate, global utilities enter the biggest contract role cycle of the last several years (see Chart 1). Most contracts are executed on a five or ten-year basis, and as the chart shows, 2005 and 2010 were the heaviest volume years going back to 1990. We believe natural buyers will be in the market to support any dip in price (again, see last night's strong rebound) starting now through the first two quarters of 2015 to secure the supply they are behind in contracting.

Most uranium-watchers are extremely focused on Japan, but why? The Fukushima disaster was responsible for the start of the uranium bear market, and many bulls have hung their hopes on Japanese restarts as the primary driver of uranium equity prices. Earlier in November, two reactors at Japan's Sendai plant received approval for restart (the first since the 2011 Fukushima event). Though important from a sentiment perspective, the restart of two reactors in and of itself does not move the demand needle. The approval is however, a game changer, but not for the reasons commonly discussed. The decision to restart removes one of the biggest short-term oversupply concerns affecting the market (another catalyzing factor for global utility buying demand).

Prior to the Sendai announcement, many uranium market participants feared that an estimated 100mm pounds of Japanese inventory would be supplied to the market if Japanese officials failed in their campaign to restart. The likelihood of this event is now dramatically reduced as it would be illogical to sell necessary uranium reserves ahead of what will be a multi-year restart effort. As a sidenote, a successful snap election for Prime Minister Abe and his LDP party bodes well for an acceleration in the restart program. The LDP party has been firmly behind nuclear restarts, but their junior coalition partner, the Komeito party, has been an opposition force. Abe looks to be in a good position to secure an outright majority, and the implicit uranium catalyst is not often cited by the market.

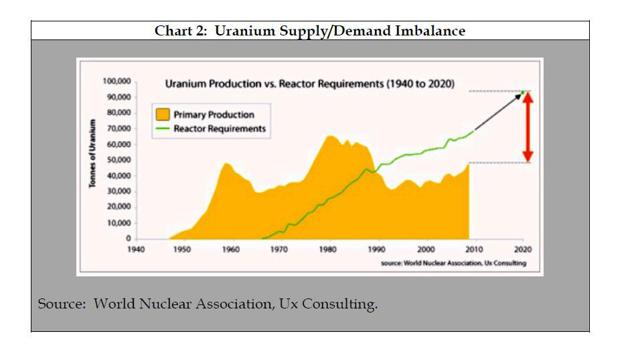

While Japan is a popular component of the uranium trade, its contribution to future demand becomes less significant when compared to the growing number of reactor builds in the rest of the world, which in aggregate are a much more important source of demand. Industry consultants and uranium company management teams alike project the uranium market going into deficit over the course of the next several years excluding the demand impact of Japanese restarts (see Chart 2). As has been pointed out many times by various sources, until spot uranium reaches some ~$75/pound, it is uneconomical for uranium supply to come online. We believe that a clearing price level of at least $75/pound will be achieved in Q1 or Q2 2015.

While the recent move in Uranium equities since the Sendai reactor announcement may seem significant, it only brings equities back to where they were trading at the end of September of this year. Perhaps more surprising, is the general divergence between the spot price and related uranium equities since the summer, which has only partially closed (see Chart 3).

(click to enlarge)

Though daily fluctuations in the spot price do not affect the operations of uranium miners such as Cameco and Denison, long-term price increases do impact the Net Asset Value ("NAV") of the companies. We believe the divergence in pricing between the commodity and equities reflects skepticism in the market about the sustainability of the underlying price move.

Our discussions with bigger market players suggest that uranium demand is strong, while supply has been surprisingly thin. Meanwhile, both Cameco and Denison trade at significant discounts to NAV - upwards of 50% based on internal calculations based on given current pricing. We believe that higher spot prices, plus an eventual normalization of NAV multiples for the sector offers 100%+ upside to several names from today's prices.

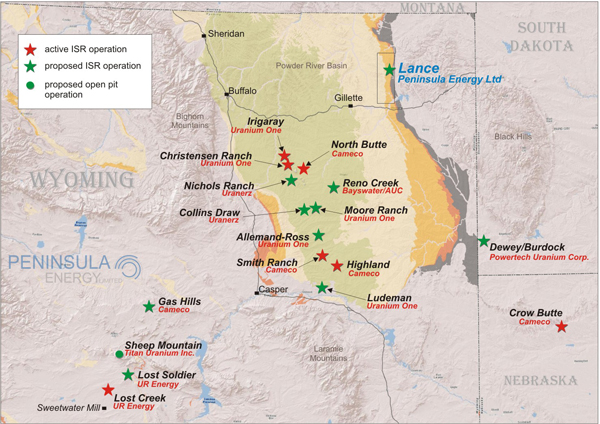

Current equity prices reflect worst-case scenarios, just as the macro tailwinds for the industry are the strongest in several years. The buying behavior of utilities coming into their contract roll cycle, in addition to the positive sentiment catalyzed by Japan's restarts is underestimated by the market. Our top pick in the sector is Denison Mines based on the prospects of its Wheel Lake Gryphon zone drilling site, 22.5% joint venture stake of the Cigar Lake asset (operated by Cameco) and possibility of a near -term non-core asset sale (assets which currently have zero value in the NAV calculation). Internal one-year price target is C$ 2.20, implying greater than 75% upside from November 25th's closing price.

Click Image To Access Uranium Stocks Australia

.