Published on Tuesday May 13 2014 (AEST)

The last year construction began on a nuclear power plant in the United States was 1977, but that is about to change.

The Department of Energy announced in February that it is backing the construction of two new nuclear power plants, and TREC,

a Woodard & Curran company, is working on a major uranium mining

project to provide the fuel that these and other plants will need. After

four years, the Nuclear Regulatory Commission (NRC) recently gave

initial permitting approval and released the final environmental impact statement for the first phase of the project where TREC will play a leading role.

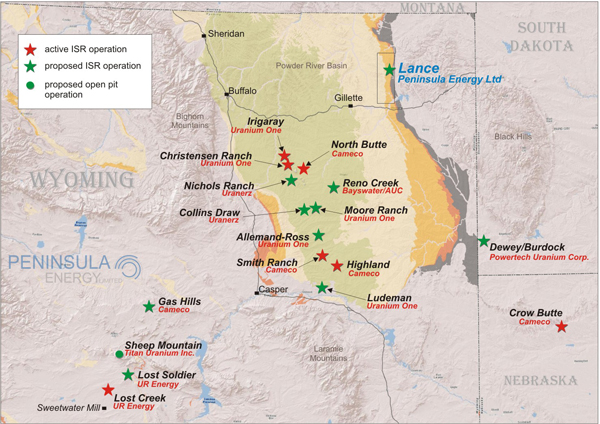

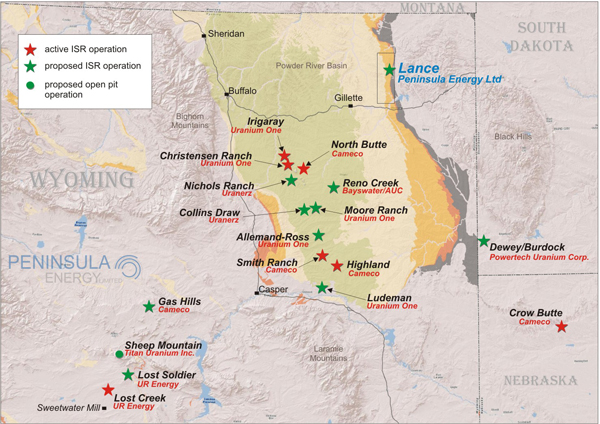

Strata’s Lance In-Situ Uranium Recovery Projects

in northeastern Wyoming encompass at least 190 combined miles of

uranium mineralization and more than 53 million pounds of triuranium

octoxide compound. TREC is leading the pre-construction activities for

the uranium processing plant under a design/build contract and providing

conceptual designs, detailed engineering design support, procurement,

and construction services.

“Designing the system is an exciting challenge for our team,” said

Brian Pile, a Regional Operations Manager at TREC. “This project is made

even more significant because it will be such an important source of

fuel for clean, low-carbon energy production in the future. We are

committed to the efficient design of a low-impact system that protects

the local ecology and creates long-term benefits for both Strata Energy

and the local economy.”

The TREC team completed each component of the facility design,

including mass balance, piping and instrumentation diagrams, and process

layouts, as well as structural and instrumentation and control

engineering. TREC also managed the laboratory, plumbing, HVAC and

architectural design work for the facilities and generated

specifications for the building, construction, equipment, pumps, tanks,

and process, mechanical, structural, and electrical controls. Woodard & Curran is assisting TREC with the electrical and instrumentation and controls aspects of the project.

Prior to construction, TREC developed performance specifications that

were provided to vendors for pricing and associated structural, safety,

and ventilation designs, which were then incorporated into the facility

design. This approach significantly reduced design costs and will

expedite the building process.

Production at the Lance Projects

The Ross Production Site, the first phase of the Lance Project, is

the area where Strata is currently focusing development and will use

in-situ recovery (ISR) to extract the uranium, rather than an open pit

or underground mine. ISR at the Ross project involves a number of

injection wells that pump a solution of groundwater mixed with oxygen

and sodium bicarbonate (lixiviant)

into the sandstone that holds the uranium. The lixiviant oxidizes and

dissolves the uranium, which is then drawn up by recovery wells. The

solution is pumped to a central processing plant, where the uranium is

extracted through an ion-exchange circuit, elution, precipitation

processes, and drying for an initial annual production rate of 1.2

million pounds of “yellowcake” by 2017. The water used to bring the

dissolved uranium to the processing plant is then re-fortified and

returned to the aquifer in the closed loop process.

The entire wellfield is surrounded by a series of perimeter

monitoring wells to guard against the migration of mining solution

outside of the recovery area. ISR requires minimal surface disturbance,

and the affected area—including the groundwater—is restored when the

mining operation is concluded.

The Ross site will contribute a significant portion of the total

United States production of uranium. According to the U.S. Energy

Information Administration, 2013 domestic uranium production totaled roughly 4.8 million pounds.

Strata is targeting 1.2 million pounds of triuranium octoxide produced

at the Ross site per year through the years 2014 – 2017 and later plans

to increase production to 2.3 million pounds per year.

The

uranium will be extracted through an ion-exchange circuit, elution,

precipitation processes, and drying for an initial annual production

rate of 1.2 Mlbs of “yellowcake” by 2017.

Construction Underway

Ground breaking commenced in October of 2013. Phase I construction

has been completed to the point feasible during the winter months. TREC

and Strata have begun procuring equipment and the pre-engineered steel

buildings to allow for the rapid continuation of construction in the

spring. Strata anticipates that the NRC will issue the Source Material

License in early April 2014, which will allow the construction of the

processing plant and initial wellfields.

“The design/build approach streamlines the process for Strata

Energy,” Pile added. “The project benefits by having one contract and

entity for design, construction, cost, and schedule management. It

really is a true turn-key delivery for the owner, which provides them

with the ability to focus on their core business.”

.

Click Image To Access Uranium Stocks Australia

.