Wednesday 26th August 2009

Greenland Minerals Limited (GGG)

Clickable Image

Volume: 4,028,375

No. of Trades: 21

Opening Price: 0.42

High Price: 0.50

Low Price: 0.42

Closed at 0.50 Up 26.58%

Clickable Image

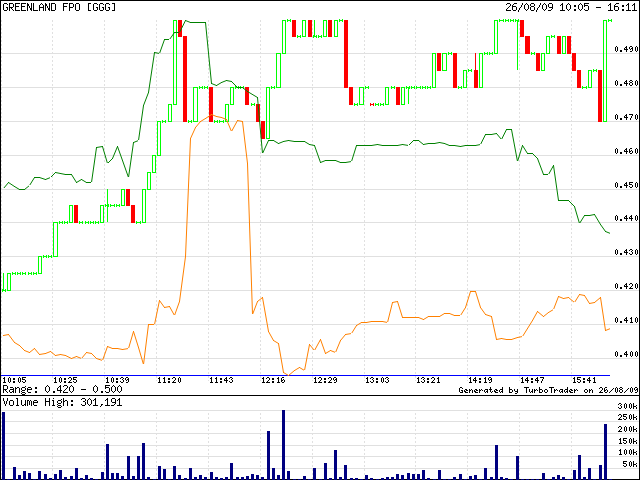

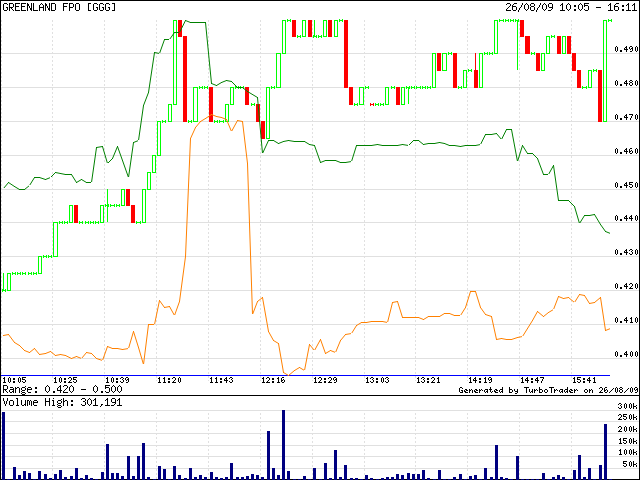

Charting Analysis Overview Of GGG's Current Trading

Click Chart To Enlarge

Chart Below Showing Cross-Over of

Buyers~~~~ over Sellers~~~~~

Greenland Minerals Limited (GGG)

Clickable Image

Volume: 4,028,375

No. of Trades: 21

Opening Price: 0.42

High Price: 0.50

Low Price: 0.42

Closed at 0.50 Up 26.58%

Clickable Image

Charting Analysis Overview Of GGG's Current Trading

# Rising Volume for 2 days

# Above 4x ADV

# Closed outside top Bollinger for 5 days

# Gapped Up

# Above 4x ADV

# Closed outside top Bollinger for 5 days

# Gapped Up

Click Chart To Enlarge

Chart Below Showing Cross-Over of

Buyers~~~~ over Sellers~~~~~

Greenlands Minerals and Energy: UraniumLetter places $1.20 share price target

Proactive Investors Australia

Uranium letter International Update and Comment:

Greenland Minerals and Energy Ltd.

Share Price: A$ 0.50

ASX : GGG

H+L prices (12 months) : A$ 0.55 – 0.15

Net issued shares : 218.5 million

Fully diluted : 387.1 million

Market capitalization : A$ 109.2 million

Fully diluted : A$ 193.5 million

(at an exercise price of A$ 0.20)

Next price target: A$ 1.20

"Greenland Minerals & Energy (ASX: GGG) has secured to acquire 61%, with options to acquire up to 100% of the Kvanefjeld Project on the southwest tip of Greenland and is recognised as the second largest undeveloped multi-element occurrences of rare earth oxides (beryllium and lithium), sodium fluoride and uranium in the world.

Particularly since having further increased and upgraded in size, the Kvanefjeld Project, with an estimated JORC compliant resource of 120,000 tonnes U3O8 grading 283 ppm, containing 223 million pounds of U3O8 (192 million pounds at 350 ppm), can be compared with Rio Tinto’s producing Rossing Uranium Mine in Namibia containing a current 174,000 tonnes Mine resource grading 300 ppm for 470 million pounds of U3O8.

Actually, apart from the Kvanefjeld Project being the world’s second largest REO project, Greenland Minerals owns one of the world’s top-5 uranium deposits. The present U3O8 resource represents a value of less than US$ 1.00 per pound (fully diluted), compared with average resource valuations in the uranium sector between US$ 3 to US$ 5 per pound U3O8.

While Greenland Minerals under an improving geopolitical climate has the potential to emerge to a multibillion dollar uranium company alone, the financial world has not recognised the Company having emerged in just two years to one of the world’s leading rare earth companies yet.

Early indications are that uranium represents approximately a quarter of the total in the ground value of the Kvanefjeld Project, to be estimated at more than US$ 40 billion.

The Company’s focus in 2009 shifts from resource development to metallurgical test work and other aspects of a pre-feasibility study scheduled to be completed in the fourth quarter of 2009, for which a budget of A$5 million has been allocated.

In addition, a budget of A$ 3-4 million is slated for ongoing exploration.

With the recent positive political developments in Greenland, having activated self-rule in June and getting 100% control of its mineral rights, the future is looking very positive for Greenland Minerals.

A national debate is planned to decide the future of uranium production. A positive decision could multiply the Company’s market valuation right away.

Based on the huge economic value of the Kvanefjeld Project, we view Greenland Minerals as one of the most attractive investment opportunities in the global rare earth and uranium industry.

Our next price objective is: A$ 1.20."

Proactive Investors Australia

Uranium letter International Update and Comment:

Greenland Minerals and Energy Ltd.

Share Price: A$ 0.50

ASX : GGG

H+L prices (12 months) : A$ 0.55 – 0.15

Net issued shares : 218.5 million

Fully diluted : 387.1 million

Market capitalization : A$ 109.2 million

Fully diluted : A$ 193.5 million

(at an exercise price of A$ 0.20)

Next price target: A$ 1.20

"Greenland Minerals & Energy (ASX: GGG) has secured to acquire 61%, with options to acquire up to 100% of the Kvanefjeld Project on the southwest tip of Greenland and is recognised as the second largest undeveloped multi-element occurrences of rare earth oxides (beryllium and lithium), sodium fluoride and uranium in the world.

Particularly since having further increased and upgraded in size, the Kvanefjeld Project, with an estimated JORC compliant resource of 120,000 tonnes U3O8 grading 283 ppm, containing 223 million pounds of U3O8 (192 million pounds at 350 ppm), can be compared with Rio Tinto’s producing Rossing Uranium Mine in Namibia containing a current 174,000 tonnes Mine resource grading 300 ppm for 470 million pounds of U3O8.

Actually, apart from the Kvanefjeld Project being the world’s second largest REO project, Greenland Minerals owns one of the world’s top-5 uranium deposits. The present U3O8 resource represents a value of less than US$ 1.00 per pound (fully diluted), compared with average resource valuations in the uranium sector between US$ 3 to US$ 5 per pound U3O8.

While Greenland Minerals under an improving geopolitical climate has the potential to emerge to a multibillion dollar uranium company alone, the financial world has not recognised the Company having emerged in just two years to one of the world’s leading rare earth companies yet.

Early indications are that uranium represents approximately a quarter of the total in the ground value of the Kvanefjeld Project, to be estimated at more than US$ 40 billion.

The Company’s focus in 2009 shifts from resource development to metallurgical test work and other aspects of a pre-feasibility study scheduled to be completed in the fourth quarter of 2009, for which a budget of A$5 million has been allocated.

In addition, a budget of A$ 3-4 million is slated for ongoing exploration.

With the recent positive political developments in Greenland, having activated self-rule in June and getting 100% control of its mineral rights, the future is looking very positive for Greenland Minerals.

A national debate is planned to decide the future of uranium production. A positive decision could multiply the Company’s market valuation right away.

Based on the huge economic value of the Kvanefjeld Project, we view Greenland Minerals as one of the most attractive investment opportunities in the global rare earth and uranium industry.

Our next price objective is: A$ 1.20."

Uranium Mine Feasibility Calculator

CLICK IMAGE FOR MINE FEASIBILITY RESOURCE CALCULATOR

No comments:

Post a Comment